केन्द्रीय बैंकको सर्कुलरसँगै शेयर बजारमा सुधारको संकेत

Author

NEPSE TRADING

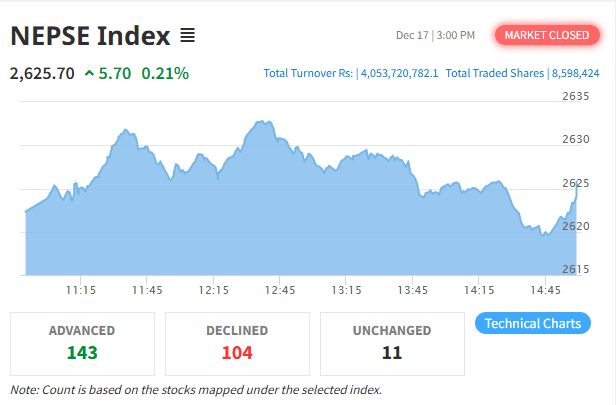

NEPSE Rises by 22.59 Points; Market Opens with Circuit, Ends with Technical Stability

Kathmandu — The final trading day of the week brought a wave of green to the Nepali stock market. After two consecutive declining sessions, the NEPSE index surged by 22.59 points, closing at 2582.18 points on Thursday. The rally was fueled by the Nepal Rastra Bank’s (NRB) decision to remove the NPR 250 million cap on margin loans for a single client, a long-standing demand of investors.

Within minutes of the opening bell, the market surged nearly 4%, triggering a positive circuit. However, after the 20-minute trading halt, the market failed to sustain the same momentum but still managed to close in positive territory.

Policy Shift Boosts Sentiment

Following weeks of economic uncertainty caused by the Gen Z protests and natural disasters such as floods and landslides, the new government’s flexible policies have renewed investor confidence.

An NRB working group formed under Rupesh KC had recently submitted recommendations to reform the capital market and restore investor sentiment. Based on these recommendations, the government implemented several major reforms — including lifting the margin loan limit, allowing banks to invest in shares for six months instead of one year, and removing the 20% cap on primary capital sales.

These policy changes are widely seen as steps toward market revival and liquidity improvement.

Trading Volume Declines Slightly

Despite the index rising, total turnover fell compared to Wednesday.

Thursday’s turnover: NPR 5.27 billion

Wednesday’s turnover: NPR 5.76 billion

A total of 118.3 million shares of 313 scrips changed hands through 56,321 transactions.

Among gainers, Bindhyabasini Hydropower surged 8.21%, Asian Hydropower gained 5%, and MBL Equity Fund rose by nearly 5%.

Thristar Hydropower, on the other hand, dropped 9.09%, becoming the day’s biggest loser.

In terms of trading value, Shivam Cements topped the list with over NPR 273 million, followed by Union Hydropower and Himalayan Reinsurance with NPR 270 million and NPR 210 million, respectively.

Sectoral Overview

Out of 13 sub-indices, 12 closed positive while the Trading sector declined.

The Investment sub-index led with a 1.61% rise, while Banking, Development Banks, Finance, Life Insurance, and Manufacturing & Processing sub-indices gained over 1% each.

Meanwhile, the Trading sub-index dropped 1.48%, remaining the sole decliner.

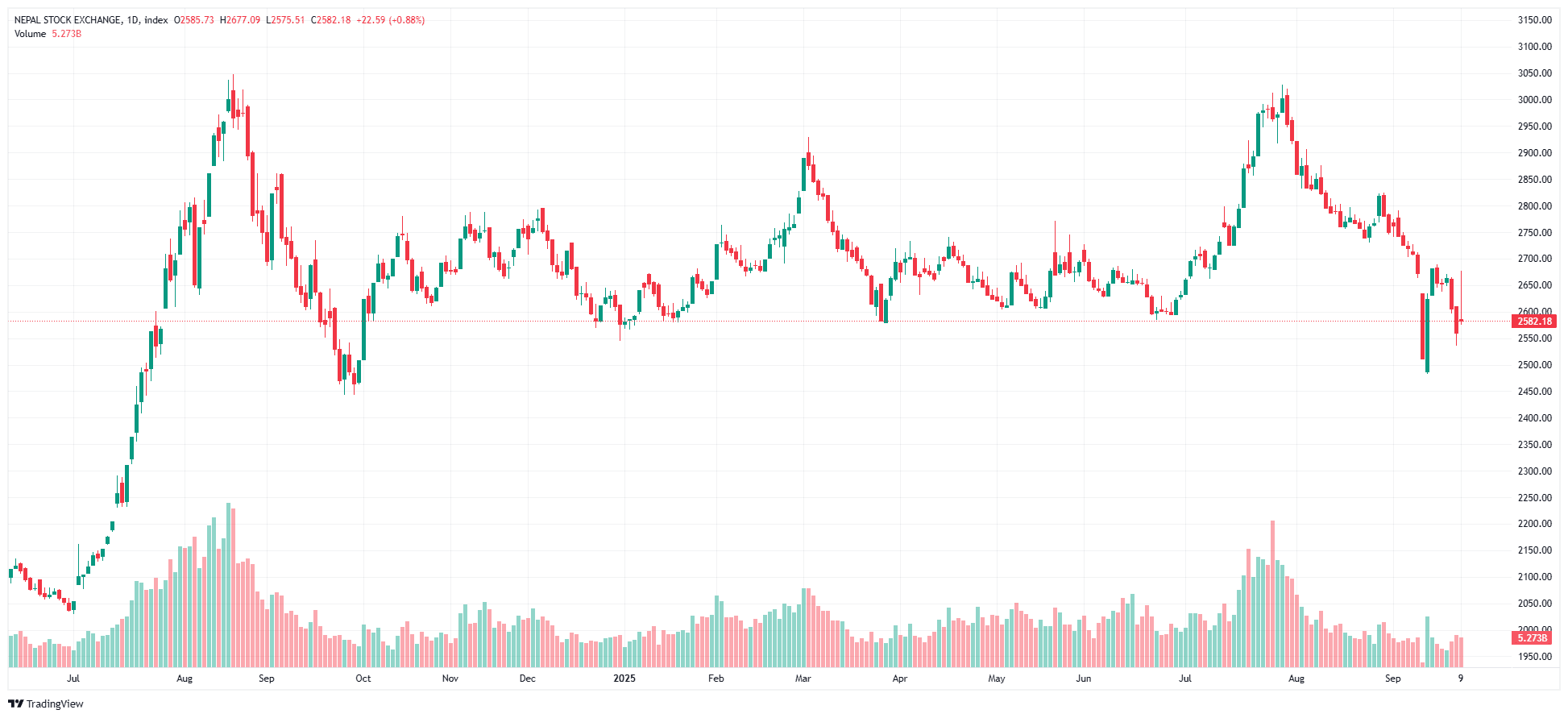

Technical Analysis: “Inverted Hammer” at Key Support

According to technical analyst Ajit Khanal, the NEPSE chart has flashed a notable technical signal.

After a gap-up opening, the index tested a minor resistance and later closed near its long-standing support zone of 2580, forming an “inverted hammer” candle — often seen as a potential bullish reversal pattern.

“This suggests the market is attempting to find a base near 2580, and a short-term bullish rebound could follow,” Khanal.

The 2700 zone remains a critical resistance area where multiple technical indicators converge:

200-day Moving Average (200MA)

Middle Bollinger Band

38.2% Fibonacci retracement level

Previous swing high and signal zone

If NEPSE manages to break above this zone in the coming sessions, analysts expect a renewed bullish momentum. Otherwise, the market may continue sideways or with weak sentiment.

Weak Buyer Momentum and Dull Afternoon Session

Despite the positive start, selling pressure dominated the session. Buyers appeared hesitant, and many investors refrained from taking new positions.

Post-noon trading was described as “dull and directionless,” signaling reduced investor participation.

Hydropower’s share in total turnover decreased, while banking, development banking, and manufacturing sectors saw moderate improvement.

Among the top 10 brokers, trading activity was evenly split — five active on the buy side and five on the sell side.